非美国居民报税所需表格概述 / Forms Required for Nonresident Aliens to File Taxes

作为 非美国居民(Nonresident Alien),如果你在美国有收入并需要报税,可能需要填写不同的税务表格。根据不同的收入类型、税务身份以及是否享受美国与其他国家的税务协定,所需的表格可能会有所不同。

As a Nonresident Alien, if you have income from the U.S. and need to file taxes, you may need to complete various tax forms. The forms required depend on the type of income, your tax status, and whether you are eligible for tax treaty benefits between the U.S. and your home country.

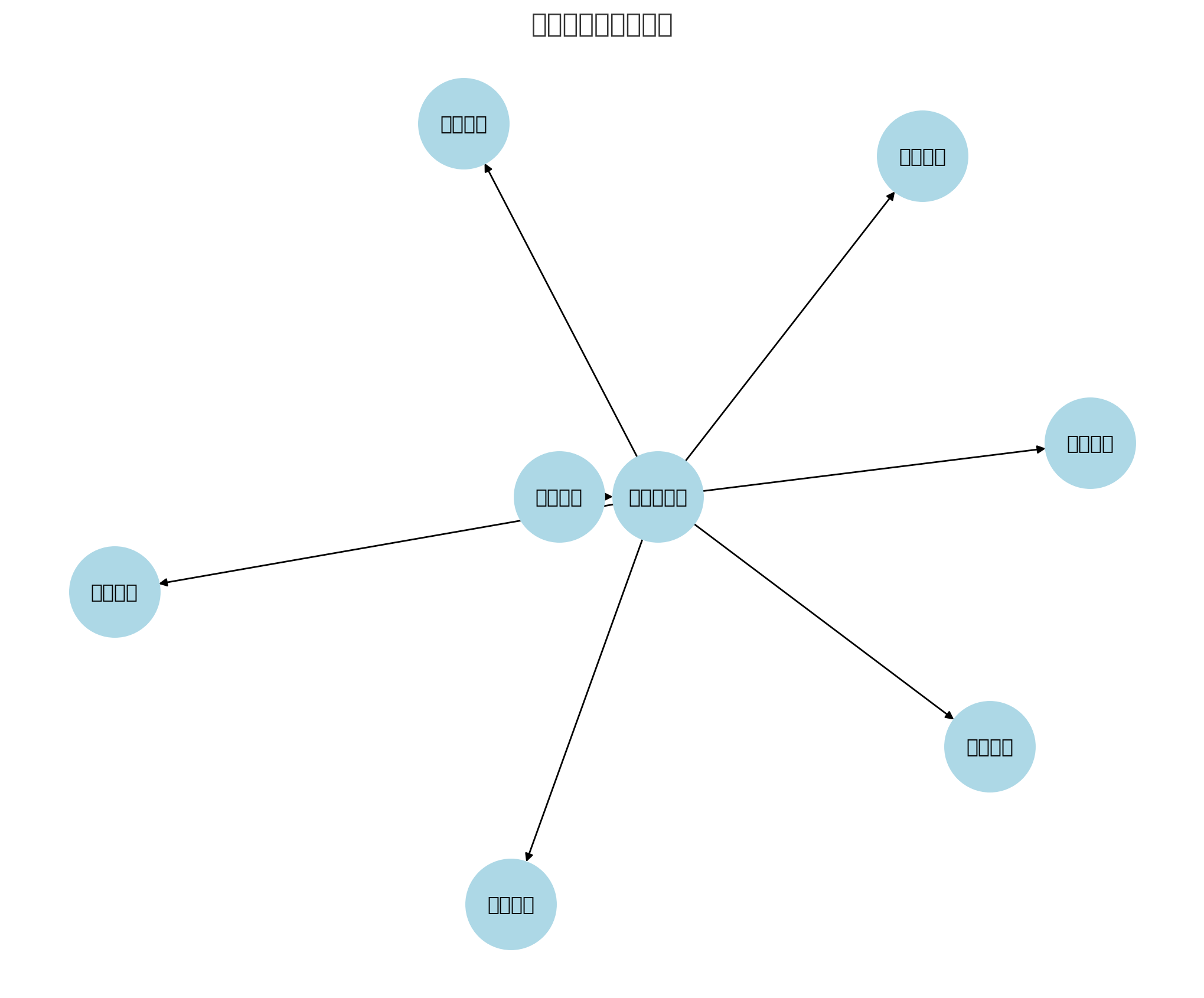

以下是最常用的 非美国居民报税表格,以及它们适用的情况:

Here are the most commonly used tax forms for nonresident aliens, along with the situations in which they apply:

1. Form 1040-NR — U.S. Nonresident Alien Income Tax Return / 美国非居民个人所得税表

适用情况 / When to Use:

如果你是 非美国居民,并且在美国有收入(如薪资、租金、投资收益等),你需要填写此表格来报告你的 美国来源收入,并计算应缴的税款。

If you are a Nonresident Alien and have income from U.S. sources (such as wages, rental income, investment income, etc.), you need to file this form to report your U.S.-sourced income and calculate your tax liability.

2. Form W-7 — Application for IRS Individual Taxpayer Identification Number (ITIN) / IRS个人纳税人识别号申请表

适用情况 / When to Use:

如果你没有 社会安全号码(SSN),但需要报税或处理美国税务事项,必须申请 ITIN(个人纳税人识别号码)。

If you do not have a Social Security Number (SSN) but need to file taxes or handle U.S. tax matters, you must apply for an ITIN (Individual Taxpayer Identification Number).

3. Form 8843 — Statement for Exempt Individuals and Individuals With a Medical Condition / 免税个人和患病个人声明表

适用情况 / When to Use:

如果你是 持F-1、J-1 签证的学生、学者或访问学者,且在美国有税务豁免身份,你需要提交此表格来声明你的 免税身份,即使你没有收入。

If you are a student, scholar, or exchange visitor holding an F-1 or J-1 visa and are exempt from U.S. taxes, you need to file this form to declare your exempt status, even if you have no income.

4. Form W-8BEN — Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding / 美国税务预扣的外国身份证明表

适用情况 / When to Use:

如果你是 非美国居民,并且拥有 美国来源的收入(如股息、利息、租金等),你需要填写此表格来证明你的 外国身份,并减免或避免 美国税收预扣。

If you are a Nonresident Alien and receive U.S.-sourced income (such as dividends, interest, or rent), you need to file this form to certify your foreign status and reduce or avoid U.S. tax withholding.

5. Form 8233 — Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual / 非居民个人独立(或某些依赖)个人服务收入免除预扣税表

适用情况 / When to Use:

如果你是 非美国居民,并且提供 独立服务(如自由职业者或独立承包商),并且有 税务协定优惠,你可以使用此表格申请 免除预扣税。

If you are a Nonresident Alien providing independent services (such as freelancing or contracting) and have tax treaty benefits, you can use this form to apply for an exemption from withholding tax.

总结 / Summary:

对于 非美国居民,报税时最常用的表格包括:

For Nonresident Aliens, the most commonly used forms for tax filing include:

-

Form 1040-NR:用于申报 美国来源收入。 / Used to report U.S.-sourced income.

-

Form W-7:用于申请 ITIN,当你没有 SSN 时需要报税。 / Used to apply for an ITIN when you do not have an SSN.

-

Form 8843:用于学生、学者等的 税务豁免身份。 / Used for tax-exempt status for students, scholars, etc.

-

Form W-8BEN:用于证明 外国身份,减少或避免 美国预扣税。 / Used to certify foreign status and reduce or avoid U.S. withholding tax.

-

Form 8233:适用于 自由职业者,申请 免税待遇。 / Used by freelancers to apply for tax exemptions.

根据你的 税务身份 和 收入来源,选择合适的表格进行填写,确保符合 美国税务要求,避免双重征税或不必要的税务问题。如果你有疑问或不确定如何填写相关表格,建议咨询专业税务顾问以确保合规。

Depending on your tax status and income sources, select the appropriate form to fill out and ensure compliance with U.S. tax requirements, avoiding double taxation or unnecessary tax issues. If you are unsure about which form to fill out or have questions, it is recommended to consult a professional tax advisor to ensure compliance.